Introduction

In the dynamic world of cryptocurrency trading, understanding market dynamics is crucial for making informed investment decisions. Bitcoin, the leading cryptocurrency by market capitalization, exhibits a range of technical behaviors that can significantly influence your investment strategy.

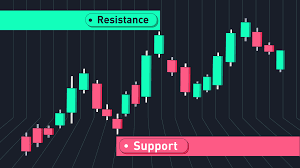

One of the most critical concepts in technical analysis for Bitcoin is the idea of resistance and support levels. These levels are fundamental in determining potential price movements and can help investors navigate the volatile cryptocurrency market. However, like any asset, its price is subject to various forces that can lead to fluctuations.

Resistance and support levels are key components in analyzing Bitcoin’s price movements. These levels help investors identify potential entry and exit points, understand market trends, and adjust their investment strategy accordingly.

Resistance refers to a price level at which Bitcoin faces selling pressure strong enough to prevent further increases. Conversely, support is a price level where buying pressure is sufficient to stop the price from falling further.

This post will delve into the concepts of Bitcoin resistance and support, exploring how these levels are established, how they influence price movements, and their significance in shaping your investment strategy.

Understanding these concepts is crucial for navigating Bitcoin’s market dynamics and optimizing your investment strategy.

1. Understanding Bitcoin Resistance and Support

Resistance and support levels are critical concepts in technical analysis that can significantly impact Bitcoin’s price trajectory. Resistance represents a price level where selling pressure tends to outweigh buying pressure, causing Bitcoin’s price to struggle to rise above that level. On the other hand, support represents a price level where buying pressure exceeds selling pressure, providing a floor for the price and preventing it from falling further.

These levels are established through historical price data, where Bitcoin’s price repeatedly tests certain levels but fails to break through or fall below them. For example, if Bitcoin’s price approaches $40,000 multiple times but fails to exceed this level, $40,000 is considered a resistance level. Similarly, if Bitcoin’s price consistently bounces back from $30,000, this level is considered a support level.

Resistance and support levels are not static; they can change based on market conditions, news events, and changes in investor sentiment. Understanding these levels involves analyzing historical price charts and recognizing patterns that indicate where these levels might occur.

2. How Resistance and Support Influence Bitcoin’s Price Movements

Resistance and support levels play a crucial role in influencing Bitcoin’s price movements. When Bitcoin approaches a resistance level, it often faces increased selling pressure, which can cause the price to stagnate or reverse. Conversely, when Bitcoin approaches a support level, it typically encounters increased buying pressure, which can lead to a price rebound or stabilization.

These levels are crucial in identifying potential price trends and reversals. For instance, if Bitcoin breaks through a resistance level, it may signal a bullish trend, as the price may continue to rise until it encounters the next resistance level. Conversely, if Bitcoin falls below a support level, it could signal a bearish trend, as the price might continue to decline until it finds a new support level.

Resistance and support levels are also used to set stop-loss orders and take-profit levels. For example, if you anticipate that Bitcoin will face resistance at $45,000, you might set a stop-loss order slightly below this level to limit potential losses if the price reverses. Similarly, you might set a take-profit order near the next resistance level to lock in gains before a potential price reversal.

3. Identifying Key Resistance and Support Levels for Bitcoin

Identifying key resistance and support levels for Bitcoin involves analyzing historical price data and recognizing significant price points where Bitcoin has experienced either selling or buying pressure. These levels can be identified using various technical analysis tools and methods, such as trendlines, moving averages, and Fibonacci retracement levels.

Trendlines: Drawing trendlines on a Bitcoin price chart can help identify resistance and support levels. An upward trendline connects higher lows, while a downward trendline connects lower highs. These trendlines can act as dynamic support and resistance levels, providing insight into potential price movements.

Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can also serve as resistance and support levels. When Bitcoin’s price approaches these moving averages, they can act as a barrier or floor for the price. A crossover of the moving averages can signal a change in the market trend.

Fibonacci Retracement Levels: Fibonacci retracement levels are used to identify potential support and resistance levels based on the Fibonacci sequence. Key levels, such as 23.6%, 38.2%, 50%, and 61.8%, are commonly used to predict where Bitcoin might encounter resistance or support during price retracements.

4. Incorporating Resistance and Support into Your Investment Strategy

Incorporating resistance and support levels into your investment strategy can enhance your ability to make informed decisions and manage risks effectively. Here are some ways to utilize these levels in your investment approach:

Entry and Exit Points: Use resistance and support levels to determine optimal entry and exit points for your Bitcoin trades. For example, consider buying Bitcoin when it approaches a strong support level and selling when it nears a significant resistance level.

Risk Management: Implement stop-loss orders just below key support levels to limit potential losses if the price falls. Similarly, use take-profit orders near resistance levels to secure gains before a potential price reversal.

Trend Confirmation: Monitor how Bitcoin behaves around resistance and support levels to confirm trends. If Bitcoin breaks through a resistance level, it may signal the start of an uptrend, while a break below a support level might indicate a downtrend.

Technical Indicators: Combine resistance and support levels with other technical indicators, such as Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to strengthen your investment strategy. These indicators can provide additional insights into Bitcoin’s price momentum and trend strength.

Conclusion

Understanding Bitcoin resistance and support levels is essential for crafting a robust investment strategy. By analyzing these critical levels, you can gain insights into potential price movements, identify optimal entry and exit points, and manage your investment risks more effectively.

Resistance and support levels are not just abstract concepts; they are practical tools that can significantly impact your investment decisions. Whether you are a seasoned trader or a novice investor, incorporating these levels into your strategy can enhance your ability to navigate Bitcoin’s volatile market and make more informed decisions.

We hope this post provides valuable insights into Bitcoin’s resistance and support levels and how they can influence your investment strategy. We invite you to share your thoughts and experiences in the comments below. How do you incorporate resistance and support into your Bitcoin trading strategy? Let’s discuss!