Introduction

Clover Finance has been making headlines in the crypto space due to a significant price movement that has caught the attention of traders and investors.

The recent breakout above a critical trendline has fueled bullish optimism, with analysts predicting a potential price target of $1.38. However, this price movement is not solely driven by technical analysis. A market sentiment shift has also played a pivotal role in shaping the trajectory of Clover Finance.

In this article, we will dive deep into the factors influencing Clover Finance’s recent price surge. We will analyze the role of the trendline breakout, examine key technical indicators, explore the changing market sentiment shift, and assess external factors such as macroeconomic trends and industry developments.

By the end, you’ll have a clearer understanding of whether Clover Finance can sustain its momentum and reach the projected target of $1.38.

Trendline Breakout: A Bullish Signal for Clover Finance

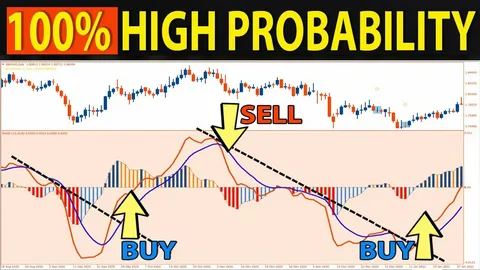

One of the biggest technical catalysts for Clover Finance’s recent price movement is the trendline breakout. For weeks, the cryptocurrency had been consolidating within a descending resistance trendline, limiting upward movements. However, a strong surge in buying pressure led to a decisive breakout, signaling a potential trend reversal.

Why Is the Trendline Breakout Significant?

- Indication of Reversal – A break above a long-term resistance trendline often suggests that bearish momentum is weakening, making way for bulls to take control.

- Increased Trading Volume – The breakout was accompanied by a noticeable surge in volume, confirming that the move wasn’t a false breakout but rather a legitimate shift in market dynamics.

- Psychological Impact on Traders – Breakouts often trigger a wave of FOMO (fear of missing out), attracting more buyers into the market.

Technical analysts are now watching key resistance and support levels to gauge whether Clover Finance can sustain its upward momentum. The next major resistance sits at $1.38, a level that could act as a short-term price target if bullish sentiment remains strong.

Market Sentiment Shift: A Key Driver of Price Action

Beyond technical indicators, a fundamental shift in market sentiment has played a crucial role in fueling Clover Finance’s bullish momentum. Sentiment in the cryptocurrency market is influenced by several factors, including social media discussions, investor confidence, and broader market conditions.

What Caused the Market Sentiment Shift?

- Increased Adoption and Partnerships – Clover Finance has recently announced new partnerships and integrations, which have improved its long-term outlook.

- Institutional Interest – Large-scale investors have been accumulating Clover Finance, signaling confidence in its future growth.

- Macro Trends Favoring Crypto – A general recovery in the crypto market, fueled by improving regulatory clarity and increasing adoption, has contributed to the positive sentiment surrounding Clover Finance.

This shift in sentiment has been reflected in social media trends and on-chain data. Twitter and Reddit discussions indicate a surge in positive mentions of Clover Finance, while blockchain data reveals an increase in the number of active addresses and transactions on the network.

With market sentiment shifting in favor of bulls, the likelihood of Clover Finance reaching $1.38 becomes increasingly plausible.

Technical Indicators Supporting the Uptrend

To assess the strength of Clover Finance’s breakout, analysts have been closely monitoring various technical indicators. These indicators provide further confirmation of bullish momentum and help traders make informed decisions.

Key Technical Indicators in Play

- Relative Strength Index (RSI) – The RSI recently crossed above 60, indicating strong buying momentum. However, it is not yet in overbought territory, suggesting more room for growth.

- Moving Averages – The 50-day moving average has crossed above the 200-day moving average, forming a bullish “golden cross” pattern. This is a classic technical signal for sustained uptrend potential.

- MACD (Moving Average Convergence Divergence) – The MACD line has moved above the signal line, reinforcing the strength of the current uptrend.

These indicators suggest that the price rally is backed by technical strength, making the $1.38 target more attainable. However, traders should remain cautious of potential retracements and market corrections.

External Factors That Could Influence Clover Finance’s Trajectory

While technical analysis and sentiment shifts are crucial, external market forces can also impact the price of Clover Finance.

Potential Catalysts for Further Growth

- Regulatory Developments – Any positive regulatory news related to crypto adoption could provide further upside momentum.

- Bitcoin’s Performance – As the leading cryptocurrency, Bitcoin’s movements often set the tone for the broader market. A sustained BTC rally could further support Clover Finance’s bullish case.

- DeFi Sector Growth – As a key player in decentralized finance (DeFi), Clover Finance benefits from increasing adoption of blockchain-based financial services.

Potential Risks to Consider

- Market Corrections – Crypto markets are notoriously volatile, and sudden corrections could impact Clover Finance’s trajectory.

- Regulatory Uncertainty – While positive regulations can be a catalyst, negative regulatory developments could slow down adoption and impact price performance.

- Profit-Taking by Whales – If large investors decide to take profits after recent gains, it could lead to temporary downward pressure on Clover Finance’s price.

By keeping an eye on these external factors, traders can better position themselves to navigate potential market fluctuations.

Conclusion

Clover Finance’s breakout above a key trendline has sparked bullish optimism, with analysts eyeing a potential target of $1.38. The combination of strong technical indicators and a market sentiment shift suggests that the cryptocurrency has room to grow. However, traders should remain cautious of external risks and market volatility.

As we move forward, continued adoption, increasing investor interest, and broader macroeconomic trends will play a crucial role in determining whether Clover Finance can reach and sustain its price target.

What are your thoughts on Clover Finance’s recent price action? Do you think it can hit $1.38, or do you see potential risks ahead? Let us know in the comments below!