Introduction

Bitcoin has once again captured the attention of investors and analysts as its price hovers around a critical support level. The cryptocurrency market has witnessed significant fluctuations in recent years, but Bitcoin’s resurgence is fueling optimism among traders. The $88K support level sets the stage for a potential breakout to $124K, a move that could signal a new era for the digital asset.

As Bitcoin continues to gain mainstream adoption and institutional backing, understanding the key price levels and market trends becomes essential. Will this support level hold? Could Bitcoin surge past its previous all-time highs? In this article, we will analyze Bitcoin’s recent price movements, the importance of the $88K support level, and the technical and fundamental factors driving the potential breakout.

Bitcoin’s Resurgence: Market Trends and Investor Sentiment

Bitcoin’s resurgence has been driven by a combination of institutional adoption, regulatory clarity, and macroeconomic factors. Over the past year, we have seen increasing demand from institutional investors, with major financial firms and corporations allocating funds to Bitcoin as a hedge against inflation. This growing interest has provided strong support for Bitcoin’s price stability and long-term potential.

Institutional Adoption and Market Confidence

One of the primary reasons behind Bitcoin’s resurgence is the continued interest from institutional investors. Companies like MicroStrategy, Tesla, and various hedge funds have added Bitcoin to their balance sheets, reinforcing confidence in the asset. Additionally, Bitcoin ETFs have gained regulatory approval in several countries, providing retail and institutional investors with easier access to the cryptocurrency market.

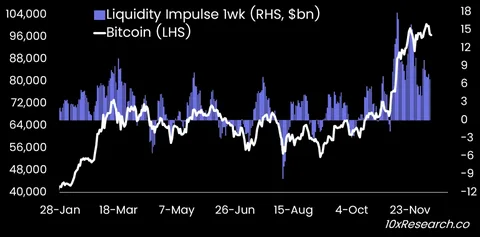

As institutional interest grows, Bitcoin’s liquidity improves, reducing volatility and making it more attractive to mainstream investors. This influx of capital has played a key role in strengthening the $88K support level, setting the stage for a potential price surge to $124K.

Regulatory Clarity and Its Impact on Bitcoin

Regulatory uncertainty has historically been a major hurdle for Bitcoin’s growth. However, recent developments in regulatory frameworks across different countries have helped establish clearer guidelines for cryptocurrency trading and investment. Countries like the United States, Canada, and parts of Europe have introduced regulatory measures that provide greater protection for investors while legitimizing Bitcoin as an asset class.

With improved regulatory clarity, investors are more confident in the long-term sustainability of Bitcoin, further solidifying the $88K support level. As regulatory uncertainty diminishes, Bitcoin’s resurgence becomes more pronounced, with the market setting its sights on the next major resistance level at $124K.

Technical Analysis: Why the $88K Support Level Sets the Stage for a Breakout

Technical analysis plays a crucial role in understanding Bitcoin’s price movements. The $88K support level sets the stage for a bullish breakout by acting as a strong foundation for price accumulation. If Bitcoin maintains this level, it could create the momentum needed to break past the $124K resistance.

Key Indicators Supporting Bitcoin’s Potential Breakout

Several technical indicators support the idea that Bitcoin is poised for a major breakout:

- Moving Averages: The 50-day and 200-day moving averages indicate a bullish crossover, signaling upward momentum.

- Relative Strength Index (RSI): Bitcoin’s RSI remains within a healthy range, suggesting that it is neither overbought nor oversold, leaving room for further upward movement.

- Fibonacci Retracement Levels: The $88K support level aligns with key Fibonacci retracement levels, reinforcing its significance as a strong support zone.

When these technical factors align, they create a favorable environment for Bitcoin to challenge higher price levels. The support level sets the stage for increased buying pressure, which could propel Bitcoin toward the $124K target.

Historical Price Patterns and Breakout Potential

Bitcoin has a history of experiencing parabolic price movements after consolidating at key support levels. Previous bull cycles have shown that when Bitcoin successfully holds a strong support level, it often leads to a significant breakout.

For instance, during the 2021 bull run, Bitcoin consolidated around $40K before surging to its then-all-time high of $69K. A similar pattern could be unfolding now, with the $88K support level setting the stage for the next major rally toward $124K.

Fundamental Drivers Behind Bitcoin’s Surge

Beyond technical analysis, fundamental factors are also playing a key role in Bitcoin’s resurgence. The combination of economic conditions, supply dynamics, and increasing adoption continues to fuel optimism in the market.

Macroeconomic Factors Favoring Bitcoin

The global economic landscape has been increasingly favorable for Bitcoin as investors seek alternatives to traditional financial assets. Some of the key macroeconomic drivers include:

- Inflation and Monetary Policy: Central banks around the world have implemented expansionary monetary policies, leading to concerns about currency devaluation. Bitcoin, often referred to as “digital gold,” has become a popular hedge against inflation.

- Geopolitical Uncertainty: Political instability and global conflicts have prompted investors to seek decentralized assets like Bitcoin as a store of value.

- Rising Institutional Interest: More institutional investors are allocating funds to Bitcoin as part of their diversified portfolios, increasing demand for the asset.

These fundamental drivers contribute to Bitcoin’s resurgence, reinforcing the significance of the $88K support level as a launchpad for further price appreciation.

Bitcoin’s Supply Dynamics and Halving Effect

Bitcoin’s fixed supply and programmed scarcity make it unique compared to traditional fiat currencies. The Bitcoin halving event, which occurs approximately every four years, reduces the rate at which new Bitcoin is created. Historically, halving events have led to significant price increases due to reduced supply and increased demand.

With the next halving event approaching, Bitcoin’s resurgence is expected to gain even more momentum. The limited supply, combined with growing institutional and retail interest, strengthens the case for Bitcoin breaking past the $124K resistance level.

The Road to $124K: Potential Challenges and Opportunities

While Bitcoin’s resurgence and the $88K support level set the stage for a potential breakout, challenges still remain. Understanding these risks and opportunities can help investors make informed decisions.

Potential Challenges

- Market Volatility: Bitcoin remains a highly volatile asset, and sudden price swings could test the $88K support level.

- Regulatory Developments: While regulatory clarity has improved, unexpected policy changes could impact investor sentiment.

- Macroeconomic Shifts: Changes in interest rates or economic conditions could influence Bitcoin’s price trajectory.

Opportunities for Bitcoin’s Growth

- Increased Adoption: More companies and financial institutions integrating Bitcoin into their services could drive further demand.

- Technological Advancements: Upgrades to Bitcoin’s network, such as scalability improvements, could enhance its utility.

- Retail and Institutional Interest: Growing awareness and accessibility to Bitcoin investment products will likely fuel further price appreciation.

With these opportunities in mind, Bitcoin’s resurgence remains a compelling narrative, and the $88K support level sets the stage for its next major move.

Conclusion

Bitcoin’s resurgence is a testament to its resilience and growing importance in the financial world. As the $88K support level sets the stage for a potential breakout to $124K, investors and traders alike are closely watching the market. With strong technical indicators, favorable macroeconomic conditions, and increasing adoption, Bitcoin appears well-positioned for its next major rally.

However, challenges remain, and market participants should stay informed about potential risks. Whether Bitcoin successfully breaks past $124K or faces further consolidation, one thing is certain: Bitcoin’s journey is far from over.

What are your thoughts on Bitcoin’s resurgence? Do you believe the $88K support level will hold? Let us know in the comments below!