Introduction

The cryptocurrency landscape is famously volatile, with Bitcoin acting as a key influencer for the entire digital asset market. When Bitcoin crosses new highs, the momentum often spreads, benefiting altcoins and even the most whimsical of tokens—memecoins.

However, a significant downturn can have the opposite effect, especially if it dips below critical psychological thresholds, like $70,000. This article explores how Bitcoin’s recent decline below $70,000 is affecting memecoins, a unique subset of the cryptocurrency market, and why the impact on these tokens often follows a different trajectory than other types of crypto assets.

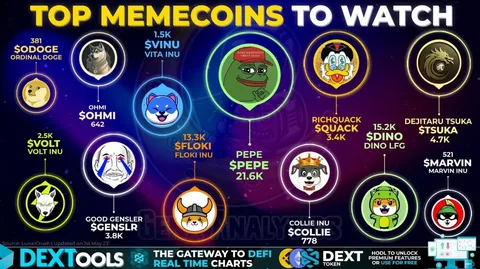

Memecoins—cryptocurrencies inspired by internet memes—have garnered massive popularity, drawing retail investors with their lighthearted origins, charismatic communities, and potential for high returns. Yet, with Bitcoin on a downtrend, these tokens face unique challenges, from reduced liquidity to increased volatility. We’ll dive into the reasons behind this impact and examine how Bitcoin’s price fluctuations influence memecoin markets.

1. Why Bitcoin’s Price is a Key Indicator for Memecoins

Bitcoin’s position as the dominant cryptocurrency means its performance largely sets the tone for the entire digital asset market. As a bellwether, Bitcoin’s trends heavily influence investor sentiment. When Bitcoin rallies, it often pulls other cryptocurrencies along, and when it declines, the effects ripple through the market, usually hitting smaller cap coins harder.

Memecoins, due to their high volatility and speculative appeal, can be particularly sensitive to Bitcoin’s price movements. As Bitcoin fell below the $70,000 mark, many investors and traders shifted focus to securing their positions in stable assets, or even fiat currencies, to avoid potential losses. For memecoin holders, the decline of Bitcoin serves as an early warning that risk tolerance might need reassessment, which often leads to sell-offs in these smaller-cap assets as investors look to minimize exposure to high-risk tokens.

2. Investor Sentiment Shifts with Bitcoin Decline

Bitcoin’s decline below $70,000 can significantly dampen investor sentiment, and this impact extends across various sectors of the crypto market. Sentiment shifts particularly harshly for memecoin communities, where enthusiasm is a driving force for growth and stability. Memecoins thrive on community hype and retail enthusiasm, which can be seriously hindered when market leaders like Bitcoin lose ground.

During bullish periods, investors are often more willing to take risks with their portfolios, allocating funds to speculative assets like memecoins. However, as Bitcoin’s value drops, investor confidence wanes, and riskier assets become less appealing. This is especially true for newer investors drawn to the excitement around memecoins but who lack the experience or risk tolerance to hold during downturns. As a result, Bitcoin’s dip below $70,000 can trigger a broader “risk-off” sentiment that severely affects the demand for memecoins.

3. Liquidity Concerns and Their Impact on Memecoins

One of the primary ways Bitcoin’s decline affects memecoins is through liquidity. When Bitcoin prices dip, investors often move their funds into stablecoins or fiat currencies to weather the storm, reducing liquidity across the board. This decrease in liquidity is particularly detrimental to memecoins, which rely on high trade volumes to maintain value stability and prevent extreme price swings.

Low liquidity can lead to high volatility, causing dramatic price drops for memecoins, which lack the resilience of more established cryptocurrencies. For example, when Bitcoin dipped below $70,000, many memecoins experienced sudden sell-offs, as lower liquidity meant that even minor market movements could lead to large price changes.

In low-liquidity environments, memecoins are especially vulnerable to “whale” movements, where large holders can significantly impact the price by buying or selling significant amounts, exacerbating the downtrend in these assets.

4. Community and Social Media Dynamics Amidst Bitcoin’s Downturn

Memecoins are unique in the cryptocurrency space due to their strong reliance on community engagement and social media hype. Bitcoin’s decline below $70,000 has a noticeable impact on these dynamics. For instance, when Bitcoin is rising, the positivity often spills over to memecoin communities, driving social media engagement, memes, and promotional activity. Conversely, in a downturn, these communities can become fragmented or subdued, reducing engagement and the social hype that often fuels memecoin investments.

The downturn affects the morale of memecoin holders, many of whom may begin questioning their investment choices when Bitcoin—seen as a “safe” digital asset—is struggling. During these times, influencers and social media figures who typically promote these tokens may reduce their activity or focus on safer investments, further diminishing the excitement and speculative influx that memecoins need to thrive. Consequently, a drop in social engagement can lead to a self-reinforcing cycle of decline, where reduced interest in memecoins leads to price drops, triggering even less community activity and engagement.

5. Memecoins as a High-Risk, High-Reward Segment in a Bearish Market

Memecoins attract investors due to their high-risk, high-reward profile, with potential for both significant gains and losses. When Bitcoin experiences a decline below critical levels like $70,000, risk appetites adjust across the market, and this segment is hit the hardest. The nature of memecoins means that they are more likely to be seen as “sell-first” assets during periods of market instability, which can lead to steeper declines compared to more established altcoins.

This “risk-off” behavior results in a large number of sell-offs in memecoins, compounding the price declines that started with Bitcoin’s downturn. In a bearish market environment, fewer investors are willing to take chances on high-risk assets, which means memecoins lose not only existing holders but also potential new investors who might otherwise be drawn by the appeal of high returns. This environment creates a tough landscape for memecoins to gain traction until broader market conditions stabilize and Bitcoin returns to an upward trend.

Conclusion

The decline of Bitcoin below the $70,000 mark has far-reaching effects on the cryptocurrency market, with memecoins being among the hardest hit. From shifts in investor sentiment to liquidity issues and reduced community engagement, these high-risk assets struggle to maintain value and attract new investment during Bitcoin’s downtrend.

However, for those who believe in the long-term potential of specific memecoins or are committed to their communities, these downturns also present buying opportunities, albeit with significant risk.

As the cryptocurrency market navigates this volatile period, Bitcoin’s influence remains as dominant as ever, dictating trends that affect even the quirkiest corners of the digital asset space. While Bitcoin’s price movements will continue to influence memecoins, these assets also rely on unique factors like community strength and social media presence that set them apart from other cryptocurrencies.

What are your thoughts on the impact of Bitcoin’s price on memecoins? Do you see this as a temporary setback or a long-term challenge for these tokens? Share your perspective in the comments below, and let’s discuss!