Cryptocurrencies have reshaped the financial landscape, and Ethereum, the second-largest digital asset by market capitalization, continues to lead the charge. Recently, analysts and traders have noticed a textbook technical pattern— the Cup and Handle—forming on it’s charts.

This bullish indicator has significant implications, potentially propelling Ethereum toward $5,441, a key psychological level. In this blog post, we’ll delve deep into the Cup and Handle pattern, explore its relevance, and analyze how it aligns with it’s trajectory.

Understanding the Cup and Handle Pattern

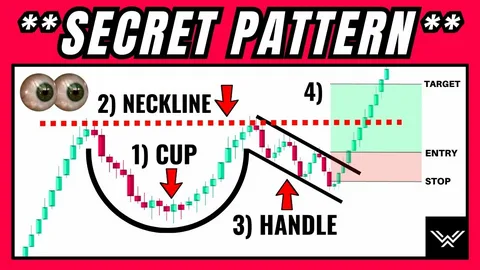

Technical analysis plays a crucial role in predicting cryptocurrency price movements. Among various patterns, the Cup and Handle stands out as a reliable signal of potential bullish momentum. This chart formation resembles a tea cup, with the “cup” forming a rounded bottom and the “handle” acting as a consolidation period before a breakout.

The Cup and Handle pattern usually forms during uptrends and signifies a temporary pause before the market continues its upward movement. For Ethereum, the cup began shaping in late 2023, as it retraced to build a rounded bottom before regaining its momentum. As the handle forms—a smaller, downward-sloping consolidation—the stage is set for a potential breakout.

Why the Cup and Handle Matters for Ethereum

For traders, the Cup and Handle pattern is synonymous with bullish potential. It reflects market psychology, showing a period of recovery after a dip and a renewed appetite for buying at higher prices. Ethereum’s current chart mirrors this behavior, signaling strong buyer confidence and growing momentum toward $5,441.

Historically, when assets form this pattern, they tend to break out with significant volume, often leading to sustained rallies. It’s recent price action suggests this is not just a short-term spike but part of a larger trend.

Ethereum’s Current Market Dynamics

Supply and Demand Factors

Ethereum’s breakout potential is deeply intertwined with its supply-demand dynamics. Several key factors have bolstered it’s position in the market:

- EIP-1559 and Ethereum Burn Mechanism

Since the implementation of it Improvement Proposal (EIP) 1559, the network has introduced a deflationary element by burning transaction fees. This reduces Ethereum’s circulating supply, enhancing its scarcity—an important driver for price appreciation. - Institutional Adoption and DeFi Growth

Ethereum remains the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs). As institutional investors pour capital into DeFi projects, Ethereum’s demand rises exponentially. This sustained interest positions it for a significant move toward $5,441. - Staking and the Shift to Ethereum 2.0

With Ethereum’s transition to a proof-of-stake (PoS) model, staking has locked a significant portion of the supply, further tightening market conditions. As more participants stake it, the available tradable supply decreases, creating conditions conducive to a breakout.

Market Sentiment Analysis

Bullish sentiment around it stems from both technical and fundamental factors. Market analysts are increasingly optimistic, with many citing the Cup and Handle pattern as a critical signal. This pattern is not forming in isolation but is accompanied by higher on-chain activity, robust NFT volumes, and expanding DeFi projects.

The broader crypto market also plays a pivotal role. Bitcoin’s resilience often leads to correlated growth in it, reinforcing the argument for it’s breakout toward $5,441.

Implications of Ethereum’s Breakout

Technical Implications

The technical implications of Ethereum completing its Cup and Handle pattern are profound. A successful breakout would validate a new support level, reinforcing it’s price trajectory. For instance:

- Key Resistance and Support Levels

Ethereum has faced resistance around $4,000, but a breakout past this point could pave the way toward $5,441. Once this resistance turns into support, it becomes a launchpad for further price growth. - Volume Confirmation

A breakout from the handle section is often accompanied by high trading volumes, confirming the strength of the move. Monitoring volume during it’s breakout will be crucial for gauging its sustainability.

Psychological Implications

Beyond technicals, it’s journey toward $5,441 carries psychological weight for traders and investors. Breaking a round number like $5,000 often attracts retail participation, amplifying price movements. Additionally, hitting $5,441 would signal it’s ability to outperform in a competitive market, bolstering investor confidence.

Broader Implications for the Crypto Ecosystem

It’s rise has far-reaching effects beyond its direct holders. A breakout could rejuvenate the broader altcoin market, often referred to as “altcoin season.” Other Ethereum-based tokens could see increased demand as it reaffirms its dominance.

Furthermore, it’s breakout could accelerate the adoption of decentralized applications (dApps), making it a pivotal moment for the blockchain space.

Risks and Challenges to Watch

While it’s Cup and Handle pattern offers a bullish narrative, potential risks remain:

- Macro-Economic Factors

The global economic climate, including interest rate decisions and regulatory developments, can influence it’s price. Adverse macro conditions could delay it’s move toward $5,441. - Competition from Layer-1 Blockchains

Ethereum faces competition from other blockchains like Solana, Avalanche, and Cardano, which offer lower fees and faster transactions. These platforms could divert some demand away from Ethereum. - Market Volatility

Cryptocurrency markets are inherently volatile. It’s breakout attempt could face temporary rejections before achieving its ultimate price target.

Despite these risks, it’s fundamentals remain strong, and its Cup and Handle pattern reinforces the bullish outlook.

What Lies Ahead for Ethereum?

Ethereum’s Cup and Handle pattern has captured the attention of traders and analysts alike. As the market anticipates a breakout, it’s fundamentals and technical indicators align, painting a picture of strong bullish potential toward $5,441.

Key Indicators to Monitor

- Handle Breakout: Watch for it breaking above its current resistance with significant volume.

- Market Sentiment: Positive news, ecosystem developments, and institutional involvement could further catalyze it’s rise.

- Macro Events: Stay updated on global economic trends and crypto-specific regulations.

Ethereum’s ability to sustain a move toward $5,441 hinges on these factors.

Conclusion

The Cup and Handle pattern has long been a reliable signal in technical analysis, and its appearance on it’s chart is no exception. Combined with strong fundamentals, this pattern indicates a high probability of Ethereum making a significant move toward $5,441.

Whether you’re a seasoned investor or a newcomer to the cryptocurrency market, Ethereum’s potential breakout offers an exciting opportunity. As we witness these developments unfold, we invite you to share your thoughts. Do you believe Ethereum will reach $5,441? What are your strategies for navigating this potential breakout? Let us know in the comments below!

0 Comments