Will Binance be next FTX?

2 min readFollowing LUNA, FTX and other crashes, is Binance at the risk of crash? Major crypto enterprises are rushing to assure customers that their funds are safe. But are they actually releasing proof — or just data?

The billionaire chief executives of the major crypto exchanges Binance and FTX, Changpeng “CZ” Zhao and Sam Bankman-Fried, have begun a public war of words after what CZ called “recent revelations” about the health of FTX’s balance sheet—warning he’s learned from the terra luna meltdown.

As FTX, formerly the world’s third-largest cryptocurrency exchange by volume, files for bankruptcy and halts withdrawals, other exchanges are working hard to assure customers that they won’t be meeting the same fate. Binance, Crypto.com, and others have started releasing partial looks at their books, while Coinbase executives are on a media tour telling investors that it’s safe to store money with their company.

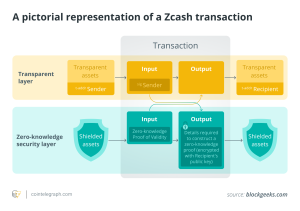

The moves are meant to assure people that their money isn’t being used on other investments and is instead held one to one. In other words, the exchanges want you to know that if you deposit a Bitcoin with them, they’ll keep a Bitcoin in reserve. That’s in contrast with FTX, which reportedly loaned billions of dollars in customer funds to Alameda Research, a trading firm also controlled by the exchange’s former CEO, Sam Bankman-Fried. Part of what triggered FTX’s spiral was a report that Alameda’s biggest asset was FTX’s token, FTT, creating a situation where the company seemed to use something akin to its own stock as collateral.

In response to this, Coinbase CEO Brian Armstrong tweeted that his company doesn’t lend customer funds and linked to a blog post from June that explains, “Coinbase always holds customer assets 1:1. This means that funds are available to our customers 24 hours a day, 7 days a week, 365 days of the year.”

Other exchanges have taken things even further, promising to show proof of reserves or evidence that they actually do have all the coins customers have deposited. Binance, the world’s largest exchange and a key figure in FTX’s downfall, put out a news post on Thursday titled “Our Commitment To Transparency,” where it shared the addresses of its hot (read: actively accessible) and cold (read: offline) wallets for the Bitcoin, Ethereum, Tron, and Binance networks. The post does say that the list is “not a complete set of data” and promises that will come with a full audited report, possibly within the next few weeks.

Nansen, a crypto analysis firm, worked with Binance to create a dashboard that visualizes the exchange’s holdings, according to Nansen’s CEO. As Bloomberg points out, Nansen’s data shows that around 40 percent of the holdings that Binance has revealed are comprised of Binance USD (BUSD), a stablecoin associated with the exchange, and BNB, the exchange’s native token.