Bulls in Bitcoin prepare for widespread volatility as the price of the cryptocurrency drops from recent all-time highs to $12,000.

Weakness in Bitcoin price targets $60,000.

Data showed again another night of declines in the price of bitcoin, which on Bitstamp had so far peaked at $60,760.

Currently, down 17.5% from its peak, selling pressure on BTC/USD persisted due to multiple significant obstacles.

These include withdrawals from US spot Bitcoin exchange-traded funds (ETFs) and the Federal Reserve’s interest rate decision dated March 20.

The Federal Open Market Committee’s (FOMC) decision is almost certain, but risk assets should closely monitor Fed Chair Jerome Powell’s subsequent remarks.

Part of a recent analysis on X (previously Twitter) by trading site The Kobeissi Letter stated, “With the Fed meeting less than 24 hours away, it’s unlikely the Fed changes rates tomorrow.”

But with the current developments, all eyes will be on direction. We continue to believe that it would be premature to change course.

According to the most recent projections from CME Group’s FedWatch Tool, there is just a 1% likelihood of a “pivot,” or a return to rate decreases, for the FOMC meeting in May and a 9.1% chance for March 20.

Analyst: Before the Bitcoin ETF recovers, “some chop first”

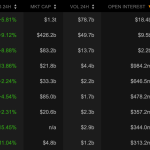

Meanwhile, data from UK-based investment firm Farside shows that net outflows from spot ETFs occurred for a second day in a row.

Although the withdrawal from the Grayscale Bitcoin Trust (GBTC) was less than the record $642 million that occurred on March 19, the data were unimpressive due to the poor inflows to the other ETF products.

Financial analyst Tedtalksmacro retorted, “Nearly $500M USD has flowed out of spot BTC ETFs in the past two trading days.”

Potential causes of the slowdown include traders taking a wait and see attitude prior to FOMC (or simply exiting the market) and the US tax season. After some cuts, regular programming will resume.