Bitcoin Price Rises by 12% Following the FOMC, Despite $260 Million in ETF Withdrawals

2 min read

Bitcoin quickly covers short positions as the price of the cryptocurrency rises in the wake of the most recent Federal Reserve meeting on economic policy. March 21 saw a continued increase in the price of bitcoin after a quick recovery offered bulls 12% gains.

Bitcoin Price Soars on the FOMC Forecast

Following a sharp reversal the day before, Cointelegraph Markets Pro and TradingView data indicated consolidation in a small range. When the US Federal Reserve decided to maintain existing interest rates, Bitcoin responded favorably to their remarks.

Following the Federal Open Market Committee (FOMC) meeting, Fed Chair Jerome Powell stated that rate reduction later in the year would be “appropriate.”

An accompanying press statement emphasized, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” In the end, BTC/USD managed to avert another retest of the $60,000 support level, instead advancing to $68,000 and completely offsetting its earlier losses.

The Third Day of Withdrawals from Bitcoin ETFs

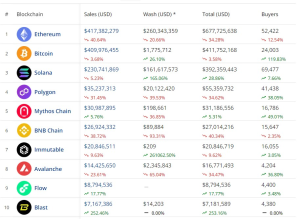

Conversely, fresh withdrawals from US spot Bitcoin exchange-traded funds (ETFs) did not further erode investor confidence. According to the most recent data from UK-based investment firm Farside, $386 million in withdrawals from the Grayscale Bitcoin Trust (GBTC) alone drove out $261 million from the new ETF products on March 20.

Inflows into the other ETFs came in at a much smaller amount than the daily revenue from earlier in the month. In response, market watchers seemed to maintain their optimism. Popular pundit Dyme said that Bitcoin’s lack of response to a third straight day of outflows demonstrated a newfound resilience against ETF influences.

A portion of an X post stated, “Today’s bounce with the negative inflow (assuming accurate and including post-market?) means that the market is not dependent on the ETFs to move up.” According to Samson Mow, CEO of the crypto adoption company Jan3, net inflows would eventually be expected even for GBTC. All outflows from Bitcoin ETFs will eventually turn into inflows. Make appropriate plans,” he said.