How to Compare Blockchains with DefiLlama

4 min read

In 2009, there was only one blockchain: Bitcoin. After fifteen years, tens of billions of dollars have been added by investors, and there are now thousands of them. Because there are so many distinct blockchains available, both users and investors must understand how to compare them and use which criteria.

This article explains why it’s important to compare blockchains using DefiLlama and how to do it.

How to Compare Blockchains with DefiLlama

- To monitor the inflows and outflows of funds across hundreds of blockchains, DefiLlama gathers publicly available data.

- Visit the DefiLlama website and select the Compare Chains option from the DeFi dashboards section to get access to it.

- Blockchains can be compared and contrasted with each other based on a number of criteria, including the total amount locked, fees and revenue, the number of active users, and the number of transactions.

Total Value Locked

The total value of bitcoin deposited into smart contracts on a certain blockchain is referred to as TVL in the context of blockchains. A blockchain’s popularity among investors is typically reflected in its higher TVL. TVL, however, is not always accurate.

Ethereum, for instance, has a far greater TVL than Bitcoin, even though Bitcoin has a three-times larger market capitalization than Ethereum. The reason for the larger TVL is Ethereum’s stronger smart contract support. Tens of billions of dollars have been deposited into DeFi protocols—such as lending protocols and decentralized exchanges—that were created with sophisticated smart contracts.

In contrast, due to its restricted capability for smart contracts, Bitcoin has a very small TVL.

Revenue and Fees

TVL is still a fantastic way to quickly assess a blockchain’s popularity, but examining additional data in the Compare Chains dashboard can lead to a more thorough assessment.

A comparison of the fees and revenue generated by two blockchains can provide information about user behavior as well as the sustainability of each network’s finances.

Let’s compare Optimism and Ethereum using DefiLlama.

As we can see, a sizable percentage of Ethereum’s transaction fees are burned rather than returned to the network as revenue. On the Ethereum layer 2 network called Optimism, a far smaller percentage of its fees becomes revenue. This is because in order to validate transactions, Optimism needs to be paid by the Ethereum network upon which it is based. Optimism holds the remaining transaction fees after Ethereum receives the majority of them from users.

Nevertheless, Optimism generates millions of dollars in revenue every month, together with other Ethereum layer 2 networks.

Active Users and Transactions

Metrics like transactions and active users are strong on their own. However, when merged, they can provide a more profound understanding of how users behave across various blockchains.

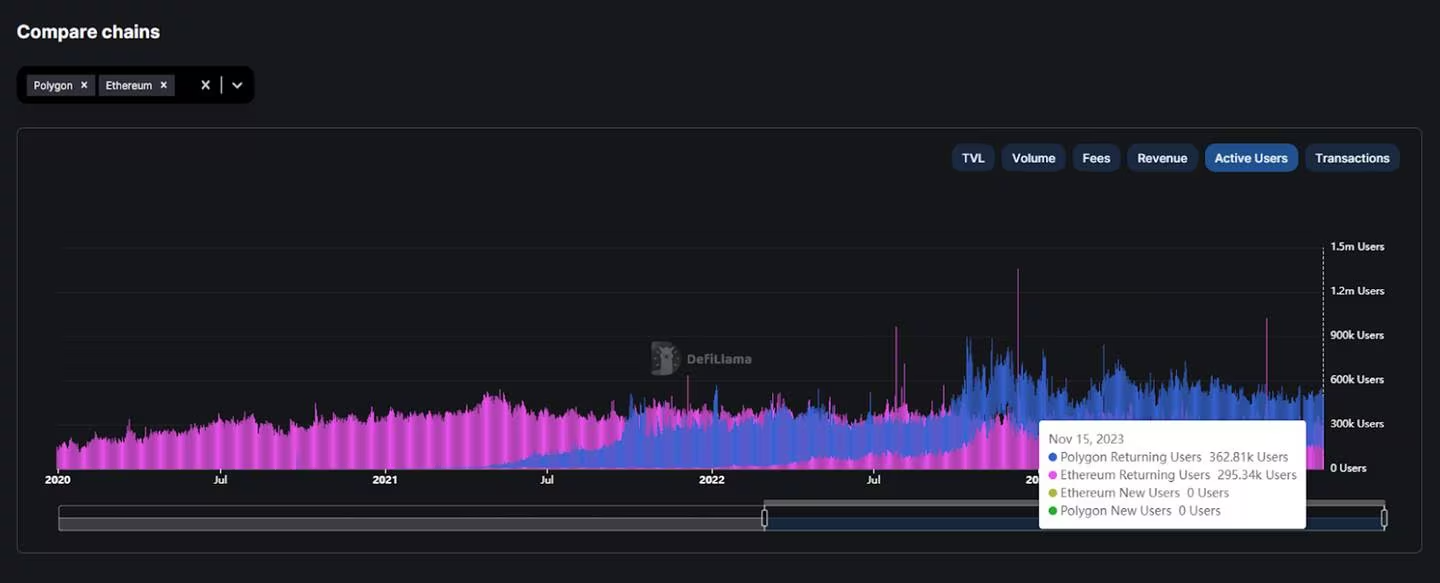

Let’s start by contrasting Polygon and Ethereum’s active user bases. The active user’s indicator on DefiLlama is equivalent to the active wallet addresses.

The sample illustrates that Polygon has somewhat more than 60,000 active addresses than Ethereum.

Let’s compare transactions next.

As we can see, Polygon handles over three times as many transactions as Ethereum.

Let’s now merge these two analogies.

- The average number of transactions made by each Polygon address on November 15 is 7.7, which can be calculated by dividing daily transactions by daily active addresses.

- However, on Ethereum, there were only 3.5 transactions on average made by each address.

- What then could be the cause of this discrepancy? Well, one factor might be the significantly higher Ethereum transaction fees compared to Polygon.

- However, exercise caution while comparing transactions, as not all blockchains provide impartial comparisons.

- Solana, for instance, has a lot more transactions than any other blockchain DefiLlama list. Is this simply a result of Solana users being more active? Perhaps not.

- The reason for this is that every time the network generates a new block, validators exchange messages with one another, accounting for over 85% of all Solana transactions. Such transactions maintain the blockchain’s operation automatically.

What Distinguishes one Blockchain From Another?

Based on their respective goals, blockchains differ fundamentally from one another, aside from factors like marketing and popularity. The way a particular blockchain resolves the so-called blockchain trilemma is largely what distinguishes it from others.

According to the blockchain trilemma, a blockchain can only ever solve two problems at once by sacrificing the third in order to attain adequate security, scalability, and decentralization.

The following definitions of security, scalability, and decentralization apply to blockchains:

- Security: Because blockchain transactions are approved by different consensus procedures, certain blockchains are more secure than others when it comes to protecting assets and data.

- Scalability: Certain blockchains are better suited for sporadic spikes in usage that cause a tidal wave of traffic because they can manage more transactions than others.

- Decentralization: A blockchain’s degree of decentralization varies. A smaller group of people make decisions in less decentralized networks, whereas the community retains power and consensus in more decentralized networks.

To attain high speeds, decentralization may have to be sacrificed for a blockchain to handle many transactions at once. On the other hand, some blockchains forgo throughput and speed in favor of increased security.

But what distinguishes blockchains from conventional payment networks is their decentralization. Networks that are truly decentralized minimize centralized weak points and are more impervious to censorship. Public blockchains, like Ethereum or Bitcoin, are the most decentralized.

Some networks, referred to as private blockchains, on the other hand, gladly forego decentralization in favor of speed and security. Some networks are invite-only, such as Sygnum’s Desygnate and ConsenSys Quorum.

The speed and security of private blockchains are excellent, but only for a limited user base. Typically, only a small number of businesses view and validate transactions.

Next actions

- Discover which blockchains have the most active users by comparing their transactions and active users.

- Examine various strategies for addressing the blockchain trilemma and learn about individuals who assert to have found a solution.